Martello Reports First Quarter Fiscal 2020 Financial Results with $3.3 Million in Revenues Representing 72% Year over Year Growth

Recurring portion of revenues grows to 87% while gross margins remain strong at 93%.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

Ottawa, Ontario (August 28, 2019) – Martello Technologies Group Inc., (“Martello” or the “Company”) (TSXV:MTLO), a leading provider of technology solutions that deliver clarity and control of complex IT environments deployed in thousands of locations around the world, today released financial results for the first quarter of the 2020 fiscal year, the three months ended June 30, 2019.

Q1 F2020 Highlights

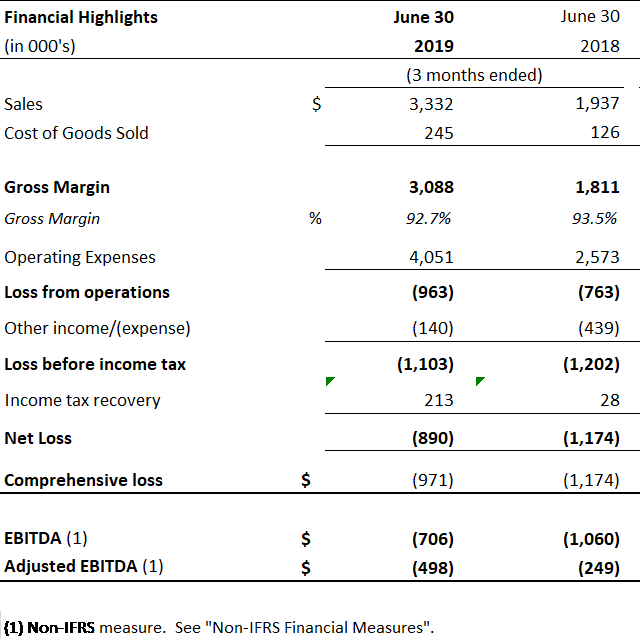

- Revenue in the first quarter of FY2020 was $3.3 million, an increase of 72% over the same period in FY2019. Organic revenue from sales of unified communications (UC) performance analytics software to the Mitel channel grew 37% this quarter, compared to Q1 FY2019.

- Recurring revenue was 87% in the first quarter of fiscal 2020, which was higher than Q1 FY2019, due to strong recurring revenue from IT Operations analytics software and a higher proportion of recurring revenue from the SD-WAN and link balancing product line.

- Gross margin as a percentage of revenue was 92.7% for the first quarter of fiscal 2020, compared to 93.5% in Q1 FY2019.

- The loss from operations in Q1 FY2020 was $963,080 compared to a loss of $762,638 in Q1 FY2019. Q1 FY2020 includes non-cash amortization of $258,084 from the acquisitions of Elfiq and Savision, and acquisition related costs of $30,878.

- Adjusted EBITDA, a non-IFRS financial measure which assesses operating performance before the impact of costs associated with acquisition activity and other non-cash costs, amounted to a loss of $498,414 for the three months ended June 30, 2019 compared to a loss of $249,042 for the three months ended June 30, 2018.

- The increased loss from operations quarter over quarter and Adjusted EBITDA loss is due to investments in sales, sales operations, marketing and support services, as well as new systems, for the purpose of creating a strong platform for revenue growth. In addition, professional and other fees have increased as a result of public company reporting requirements and investor relations activities.

“Martello is a solid investment grade technology company with significant upside and a trusted technology platform from which to grow”, said John Proctor, President and CEO of Martello. “Strong recurring revenues and exceptional gross margins offer stability and predictability, while our global client base and expanding portfolio of products brings diversity to our business model. This stability and diversity can offer downside protection in a volatile market”.

Outlook

Martello’s technology stack continues to expand through acquisitions, and with thousands of customers around the world using the Company’s products, this creates a strong foundation from which to drive business in new and existing sales channels. The Company continues to pursue its strategy of organic growth through development of integrated solutions which address the network challenges relating to unified communications and enterprise applications, and through the expansion of the Company’s distribution network for existing and integrated solutions. At the same time the Company is aligning its inorganic growth, through acquisition, with this integrated approach to ensure both sales and R&D efficiencies. Growth will continue to be a blend of the organic and inorganic with a systematic approach ensuring the alignment of both.

The Company has enough funding for operations for the foreseeable future. Martello’s recurring revenue, strong gross margins, global client base and expanding product portfolio offer stability to the business. Cross selling current products down acquired channels and selling acquired products down current channels remains key to the Company’s growth strategy.

In addition, the Company has established a strong platform for future acquisitions with investments to expand the R&D and product management teams, enhance sales and marketing activities, and implement new systems to drive efficiencies. As a result, future acquisitions will integrate more effectively, enhancing the Company’s product lines and driving additional revenue and EBITDA.

Conference Call Details

Martello will host a conference call and audio webcast with John Proctor, President & CEO and Erin Crowe, CFO at 8:00 AM Eastern Time on August 28, 2019.

Canada/USA Toll Free: 1-800-319-4610

International Toll: +1-604-638-5340

Callers should dial in 5 – 10 min prior to the scheduled start time and simply ask to join the Martello call.

An audio recording of the call will be available on August 28, 2019.

Investor Day

Martello will host an Investor Day in Toronto, Canada on Tuesday, September 24th. The event will be hosted by Martello CEO John Proctor and Co-Chairmen Sir Terry Matthews and Bruce Linton. Interested brokers and analysts can register to attend on Martello’s website.

Business Highlights

During the first quarter of fiscal 2020 Martello achieved the following milestones:

- Martello moved up 20 spots on the widely respected Branham300 listing of Canada’s top ICT (Information and Communications Technology) companies, after debuting on the list in 2018.

- The Company announced a partnership with GuestTek to deliver reliable high speed internet access (HSIA) to some of the world’s most respected hotel brands.

- Martello showcased a proof of concept developed in collaboration with BlackBerry QNX which demonstrated that Martello’s technology could maintain network connectivity for mobile IoT applications such as autonomous vehicles.

- Martello extended its relationship with longstanding customer Leiden University Medical Center (LUMC) in the Netherlands, to provide a solution improving the performance of hybrid cloud-based services.

Subsequent Activities

Subsequent to June 30, 2019, Martello achieved the following milestones:

- Responded to demand for IT Service Assurance Solutions for Large Enterprises and MSPs by teaming with Paessler AG, to simplify IT service assurance for complex IT environments.

- Announced that global IT service integrator Onepoint purchased a three year subscription to Martello’s software for a single service-oriented view of their infrastructure, improving their quality of service.

- Partnered with Suria Business Solutions, a provider of IP Telephony and Unified Communications & Collaboration (UCC) systems, applications, service and solutions to more than 500 customers in Malaysia and Indonesia.

Financial Highlights

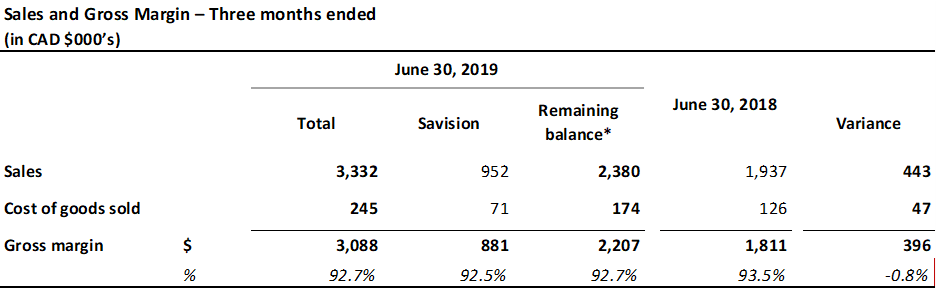

Martello reported revenues of $3.3 million in the first quarter of fiscal 2020, a 72% increase over the same period of the 2019 fiscal year, due to organic growth and the acquisition of Savision in November 2018. Gross margin remained strong at 92.7%.

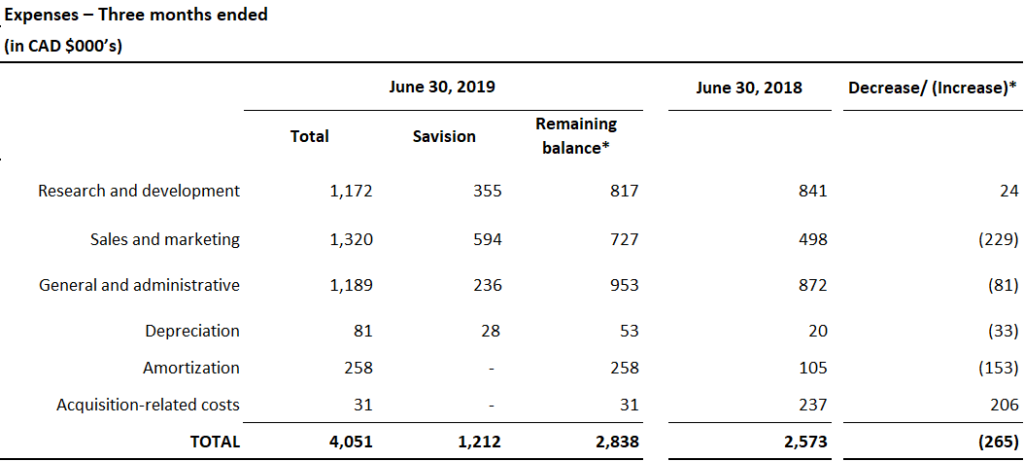

* To facilitate comparison with the three months ended June 30, 2018, the Remaining balance represents the results of the Company’s operations in Q1 FY20 without contributions from Savision (acquired in November 2018). The analysis compares the Remaining balance to the comparable period in FY2019.

* To facilitate comparison with the three months ended June 30, 2018, the Remaining balance represents the results of the Company’s operations in Q1 FY20 without contributions from Savision (acquired in November 2018). The analysis compares the Remaining balance to the comparable period in FY2019.

Sales represent:

(a) the sale of UC performance management solutions for real-time communications;

(b) the sale of hardware and software link balancing and bandwidth management solutions, and maintenance and support services for these solutions; and

(c) the sale of perpetual and subscription software licenses for visualization of IT systems management data, and maintenance and support services for these solutions.

Martello offers subscription sales (software/hardware as a service), product sales (network appliances) and software licence sales. Martello’s sales are both indirect, via distributors and value-added resellers, and direct to enterprises. Martello’s UC performance analytics software is included in Mitel’s premium software assurance plans (Mitel Performance Analytics or ‘MPA’) and Martello earns a monthly fee for each subscriber to the plan.

Recurring revenue includes fees earned on a monthly per-user basis, fees earned monthly from device usage and revenue from subscription to software licenses, all from performance analytics for unified communications. In addition, recurring revenue includes maintenance programs on hardware and software link balancing and bandwidth management solutions; subscription sales, maintenance and support on the licenses for visualization of IT systems management data; and support for UC enterprise management software.

Cost of goods sold represents the costs of hardware, delivery and installation, sales commissions and web services.

Performance of Operating Segments

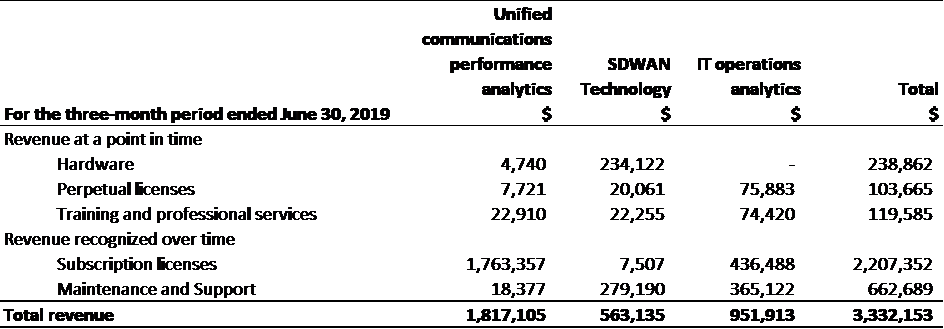

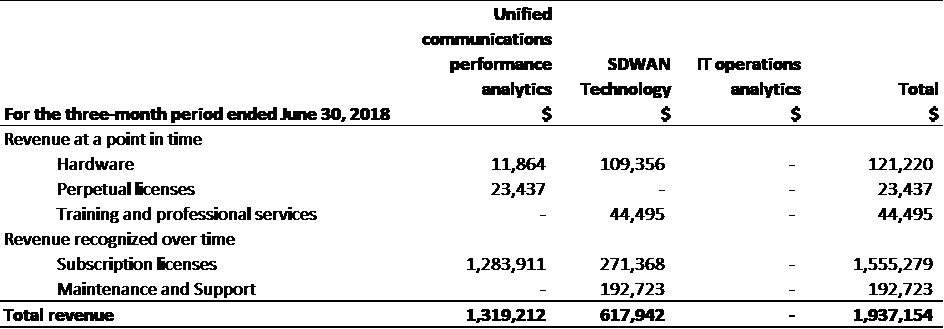

The Company operates in three operating segments: 1) Unified communications performance analytics software; 2) SD-WAN and link-balancing hardware and software; and 3) IT operations analytics software. These segments engage in business activities from which they earn revenues from subscription and perpetual software licenses, hardware, maintenance and support, and training and professional services.

Segmented revenue for the 3 months ended June 30, 2019 and June 30, 2018 is summarized as follows.

Revenue grew 23% between Q1 FY2019 and Q1 FY2020, excluding Savision. This reflects organic growth of 37% from the Mitel channel, due to an increase in recurring revenue from the number of users for Mitel’s premium software assurance program, a one-time adjustment to revenue of $154,683, and an increase in fees from Mitel resulting from the amendment to the Company’s agreement with Mitel.

SD-WAN and link balancing sales declined 9% in Q1 FY2020. In Q1 FY2019 SD-WAN revenue included services and training revenue of $45,000 which was non-recurring, as well as a small export grant which was completed in Q1 FY2019. No similar services and training or grant revenue was earned in Q1 FY2020. These decreases were partially offset by an increase in maintenance and support revenue quarter over quarter. Martello is undertaking a planned strategic shift to focus on the growing market demand for the optimization of real-time services with SD-WAN technology, which we expect will create a recurring revenue opportunity for this line of business.

The gross margin at 92.7% is slightly below the same period in FY2019 (93.5%), as a result of increases in web hosting costs due to testing requirements in the quarter.

Customer Growth

Martello generates revenue from both new business and the renewal of existing software and maintenance subscriptions. In the first quarter of fiscal 2020, the Company’s focus was on generating recurring, subscription based deals and renewals. In the Savision line of business Martello sold or renewed software subscriptions to customers including Covia, Richweb and Onepoint. Other customers that Martello earned business from in Q1 FY2020 included Indian Prairie School District, United Nations, Innova IT and Mandarin Oriental Hotels in Asia and Northern Africa.

Martello continued to see global sales growth in the first quarter of fiscal 2020, with 56% of revenues derived outside of Canada. In Q1 FY2020 the Company signed new partner Suria Business Solutions in Malaysia, and new customers in regions such as Colombia, Czech Republic, Belgium, the United Kingdom, the United States, New Zealand, Norway, the Netherlands, France, Qatar and Peru.

* To facilitate comparison with fiscal year 2019, the Remaining balance represents the results of the Company’s operations in fiscal year 2020 without contributions from Savision (acquired in November 2018) operations. The analysis compares the Remaining balance to the comparable period in FY2019.

For the three months ended June 30, 2019, operating expenses increased by $1,477,299. Excluding Savision, the increase was $264,926. As Savision was acquired on November 1, 2018 the following year over year analysis excludes Savision.

Research and development (“R&D”) expenses decreased $23,787 quarter over quarter. R&D expenses include salaries and other benefits and compensation for the research and development team as well as any sub-contract costs and development tools. The decrease in R&D costs is due to IRAP funding in FY2020 which is greater than the SRED credits in Q1 FY2019, offset partially by increased headcount relating to investment in product management and developers.

Sales and marketing costs increased $228,754 from Q1 FY2019 to Q1 FY2020. This was due to the investment in marketing and sales resources to develop capacity for future revenue growth.

General and administrative costs increased by $80,548 due to investments being made in creating a foundation for future growth, primarily shared services headcount additions and implementation of new software systems. In addition, the increase is driven by investor relations activities, and audit, tax, director and other professional fees associated with being a public company.

Acquisition related costs in Q1 FY20 relate to M&A advisor fees. Costs in Q1 FY19 related to the acquisition of Elfiq and preliminary costs associated with the Savision transaction.

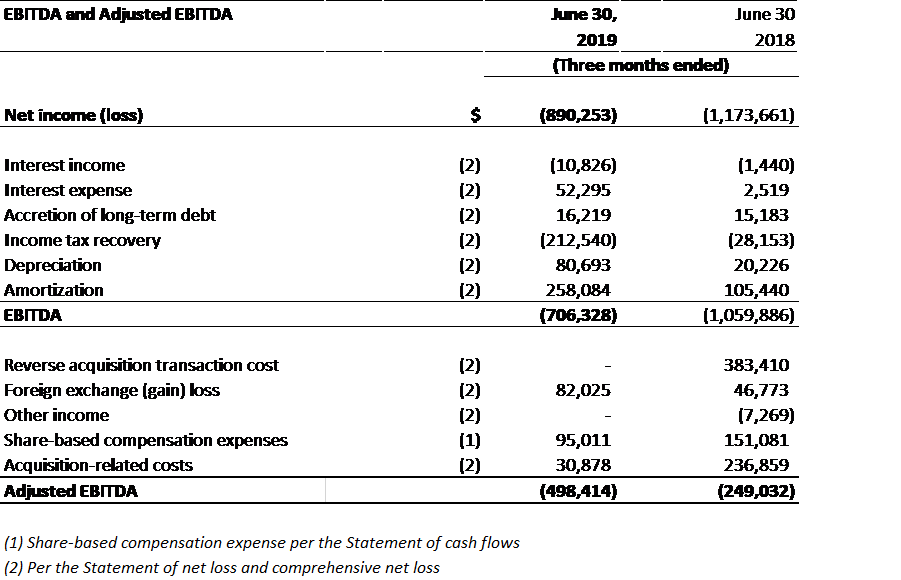

EBITDA and Adjusted EBITDA Summary (Non-IFRS financial measures)

The Company’s “EBITDA” and “Adjusted EBITDA” are non-IFRS financial measures used by management that do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies. EBITDA is calculated as net loss before interest income, interest expense, accretion of long-term debt, income tax recovery, depreciation and amortization. Adjusted EBITDA is calculated as EBITDA excluding share-based compensation expense, reverse acquisition costs, acquisition-related costs and foreign exchange gain/loss. Management believes Adjusted EBITDA is a useful financial metric to assess its operating performance on an adjusted basis as described above.

Adjusted EBITDA in the three months ended June 30, 2019 was a loss of $498,414, compared to a loss of $249,032 in the three months ended June 30, 2019. As further described in Martello’s Management Discussion and Analysis (MD&A) for Q1 FY2020 under “Changes in accounting policy”, the Company adopted IFRS 16, Leases (“IFRS 16”) using the modified retrospective approach on April 1, 2019 and, accordingly, comparative figures were not restated. Depreciation expense on right-of-use assets of $42,858 has been classified as Depreciation for the three months ended June 30, 2019, and included in the Adjusted EBITDA reconciliation. For more information on EBITDA and Adjusted EBITDA, consult the MD&A document for Q1 FY2020, available on sedar.com

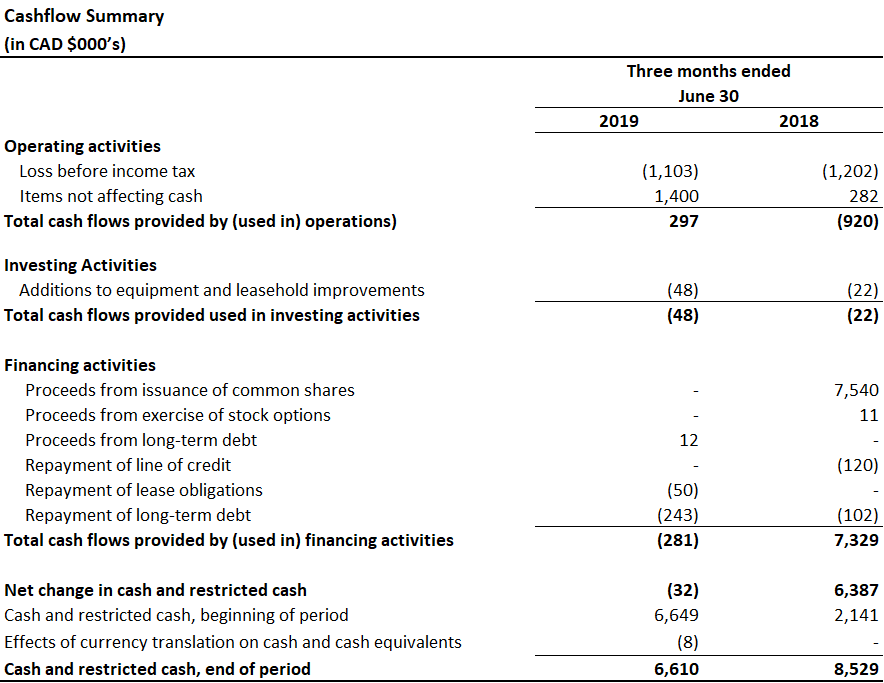

Cashflow and Capital Resources Summary

Cashflow and Capital Resources Summary

At June 30, 2019, the Company had $6.65M of cash and restricted cash on hand, and $3.7M of net working capital to fund operations and growth.

The Company’s objectives in managing its liquidity and capital structure are to generate sufficient cash to fund the Company’s operating objectives, including organic growth and growth through acquisitions.

To date, the Company has financed its operations through the issuance of common shares, raising of long-term debt, as well as the receipt of government loans, investment tax credits and revenue generated from the sale of its products and services

For the foreseeable future, the Company expects to continue financing its operations through raising equity capital and long-term debt to strengthen its financial position and to provide sufficient cash reserves for growth and development of the business. In addition, the Company is focused on generating cashflow from operations while maintaining strong investment in research and development to maintain current revenue and drive increased growth.

In June 2018, the Company closed a private placement of $7,585,311, which is being used to fund general working capital, possible future acquisitions and to support the reverse takeover transaction.

In September 2018, the Company entered into an agreement with NRC-IRAP to fund up to $2,000,000 of development costs over three years for certain projects including the hiring of additional staff.

On November 1, 2018, in connection with the Savision acquisition, the company closed a loan facility with RBC and drew $3,000,000 on the term loan. The loan also includes a $1,000,000 revolving facility which is undrawn as of the date of Martello’s Q1F2020 MD&A.

The Company believes that cashflow from operations, the receipt of funds from the private placement, proceeds from the RBC Loan and available cash and working capital will be sufficient to fund organic growth over the next year.

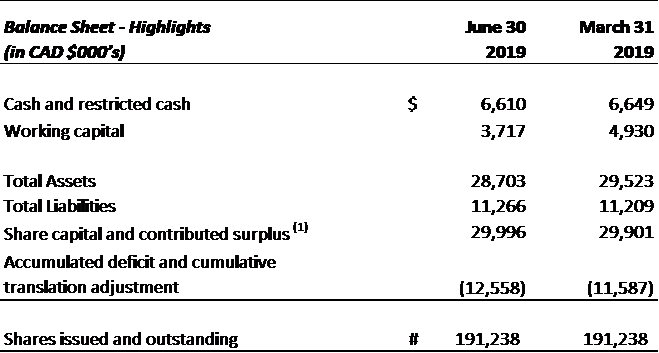

Balance Sheet – Highlights

(1) The Company had 191,237,568 shares issued and outstanding as at June 30, 2019 (191,237,568 as at March 31, 2019).

(1) The Company had 191,237,568 shares issued and outstanding as at June 30, 2019 (191,237,568 as at March 31, 2019).

The financial statements, notes and Management Discussion and Analysis (“MD&A”) are available under the Company’s profile on SEDAR at www.sedar.com, and on Martello’s website at www.martellotech.com. The financial statements include the wholly-owned subsidiaries of Martello. All amounts are reported in Canadian dollars.

One institutional investment firm has initiated research coverage of Martello. The Company does not endorse the research of third party institutions.

About Martello Technologies Group

Martello Technologies Group Inc. (TSXV: MTLO) is a technology company that provides clarity and control of complex IT infrastructures. The company develops products and solutions that monitor, manage and optimize the performance of real-time applications on networks, while giving IT teams and service providers control and visibility of their entire IT infrastructure. Martello’s products include SD-WAN technology, network performance management software, and IT analytics software. Martello Technologies Group is a public company headquartered in Ottawa, Canada with offices in Montreal, Amsterdam, Paris, Dallas and New York. Learn more at https://www.martellotech.com

This press release does not constitute an offer of the securities of the Company for sale in the United States. The securities of the Company have not been registered under the United States Securities Act of 1933, (the “1933 Act”) as amended, and may not be offered or sold within the United States absent registration or an exemption from registration under the 1933 Act.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assume no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities law. Additionally, the Company undertakes no obligation to comment on the expectations of, or statements made, by third parties in respect of the matters discussed above.

CONTACTS:

Tracy King

Vice President of Marketing

tking@martellotech.com

613.271.5989 x 2112

John Proctor

President & CEO

jproctor@martellotech.com

613.271.5989

Martello provides the only end-to-end Microsoft Teams performance monitoring tool that Microsoft recommends to their customers to maximize employee productivity.

Our solution Vantage DX proactively monitors Microsoft 365 and Teams service quality, enabling IT with complete visibility of the user experience to ease troubleshooting of issues before they impact users.

Find out why Martello is Microsoft’s go-to-solution for Microsoft Office 365 Monitoring >>